jeffereygibbon

About jeffereygibbon

Understanding Gold 401(k) Plans: A Comprehensive Study

Introduction

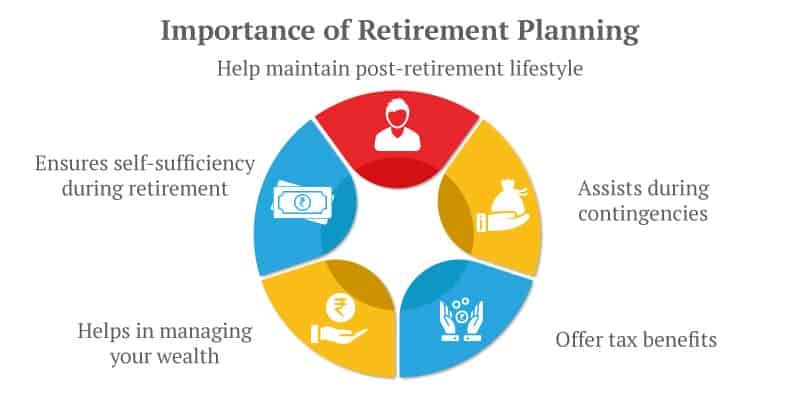

In recent years, the landscape of retirement planning has evolved significantly, with many individuals seeking alternative investment options to secure their financial future. One such option that has gained popularity is the Gold 401(k) plan. This study report aims to provide a detailed understanding of Gold 401(k) plans, exploring their features, benefits, risks, and the process of setting them up.

What is a Gold 401(k)?

A Gold 401(k) is a type of self-directed retirement account that allows individuals to invest in physical gold and other precious metals as part of their retirement savings. Unlike traditional 401(k) plans, which typically invest in stocks, bonds, and mutual funds, a Gold 401(k) gives investors the opportunity to diversify their portfolios by including tangible assets such as gold bullion, coins, and other forms of precious metals.

Key Features of Gold 401(k) Plans

- Self-Directed Investment: One of the primary features of a Gold 401(k) is that it allows participants to have direct control over their investment choices. This self-directed approach enables individuals to allocate a portion of their retirement savings to gold and other precious metals.

- Physical Ownership: Gold 401(k) plans typically involve the physical ownership of gold, which means that the investor can hold the actual metal rather than just paper assets. This can provide a sense of security, especially in times of economic uncertainty.

- Tax Advantages: Like traditional 401(k) plans, Gold 401(k)s offer tax-deferred growth. This means that investors do not pay taxes on their gains until they withdraw funds during retirement, potentially allowing for significant tax savings.

- Diversification: Investing in gold can serve as a hedge against inflation and market volatility, providing diversification that can enhance the overall stability of a retirement portfolio.

Benefits of Gold 401(k) Plans

- Inflation Hedge: Gold has historically been viewed as a reliable store of value, particularly during periods of high inflation. By including gold in a 401(k) plan, investors can protect their retirement savings from the eroding effects of inflation.

- Market Volatility Protection: Gold often performs well during economic downturns and periods of market instability. This characteristic makes it a valuable addition to a retirement portfolio, as it can help mitigate losses from other investments.

- Tangible Asset: Unlike stocks and bonds, gold is a physical asset that can be held and stored. This tangible nature can provide investors with peace of mind, knowing that they possess something of intrinsic value.

- Long-Term Growth Potential: Over the long term, gold has demonstrated a tendency to appreciate in value, making it an attractive option for retirement investors looking for growth.

Risks Associated with Gold 401(k) Plans

- Market Fluctuations: While gold is often considered a safe haven, its price can still be subject to fluctuations based on market conditions, geopolitical events, and changes in demand. If you liked this article and you would certainly such as to obtain even more information relating to iragoldinvestments.org kindly see the web site. Investors should be prepared for potential price volatility.

- Storage and Security: Physical gold must be stored securely, which can incur additional costs. Investors need to consider the logistics of storing their gold, whether in a safe deposit box or through a specialized storage facility.

- Limited Investment Options: While a Gold 401(k) allows for investment in gold and other precious metals, it may limit the ability to invest in other asset classes. This could reduce overall diversification if not managed properly.

- Regulatory Considerations: Gold 401(k) plans are subject to specific regulations and guidelines set forth by the Internal Revenue Service (IRS). Investors must ensure compliance to avoid penalties and maintain the tax-advantaged status of their accounts.

Setting Up a Gold 401(k) Plan

- Choose a Custodian: The first step in establishing a Gold 401(k) is to select a custodian that specializes in self-directed retirement accounts. The custodian will manage the account and ensure compliance with IRS regulations.

- Fund the Account: Once a custodian is selected, the next step is to fund the Gold 401(k). This can be done through contributions from the individual’s salary or by rolling over funds from an existing retirement account.

- Select Gold Investments: After funding the account, investors can choose which types of gold investments to include in their portfolio. This may involve purchasing gold bullion, coins, or exchange-traded funds (ETFs) that track the price of gold.

- Storage Solutions: Investors must determine how they will store their physical gold. Many custodians offer secure storage options, while others may require investors to arrange their own storage solutions.

- Monitor and Adjust: As with any investment strategy, it is essential to regularly monitor the performance of the Gold 401(k) and make adjustments as needed. This may involve rebalancing the portfolio or adjusting the allocation to gold based on market conditions.

Conclusion

In conclusion, a Gold 401(k) plan offers a unique opportunity for individuals seeking to diversify their retirement portfolios with physical gold and precious metals. While there are numerous benefits, including inflation protection and market volatility mitigation, investors must also be aware of the associated risks and regulatory considerations. By understanding the features and processes involved in setting up a Gold 401(k), individuals can make informed decisions that align with their long-term financial goals. As the demand for alternative investments continues to grow, Gold 401(k) plans may play an increasingly important role in retirement planning strategies.

References

- Internal Revenue Service (IRS). (2023). Publication 590-A: Contributions to Individual Retirement Arrangements (IRAs).

- World Gold Council. (2023). Gold Demand Trends.

- Investopedia. (2023). What Is a Gold 401(k)?

- U.S. Securities and Exchange Commission (SEC). (2023). Investor Bulletin: Gold and Precious Metals Investing.

No listing found.